Buying a home is not less than a dream turns reality. But it takes a huge investment to buy a home of your dreams. Moreover, if you take a loan then half of your age is wasted in worrying about the repayment on time. Repayment of home loan continues even after you and the burden comes on your loved ones. Hence, insurance is necessary. In Malaysia, almost half of the population doesn’t even care about getting them protected. Giving a permanent living space to the loved ones is good but they should not live their whole life in debt after you leave them or in case of total permanent disability. Thus you should understand the importance of MRTA and MLTA.

Everyone should know about these two types of insurance. We will cover them in the article and also tell which one you should get.

MRTA or MLTA

Often homeowner misunderstands both the terms as they seem similar but in reality, they differ. MRTA is mortgage reducing term assurance. MLTA is mortgage level term assurance.

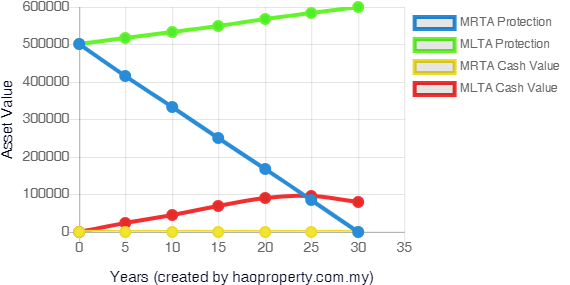

MRTA- the purpose of this insurance is to provide protection from temporary partial disability or death. It is also called a mortgage decreasing term assurance as it keeps on reducing annually. The company will pay the sum during that period only.

MLTA- it is also the same but the borrower against a few more options including critical illness. However, it does not reduce with time like MRTA. Also, the borrower can increase home loan coverage and use its saving feature. But it does not come with the loan package instead the borrower has to take it separately from a third party insurance provider.

The major difference between MLTA and MRTA

- MRTA's purpose is to protect against TPD or death whereas MLTA in addition to protect cash value and saving.

- The sum of insurance reduces throughout the loan tenure in MRTA whereas the sum remains fixed during the tenure in MLTA.

- MRTA is not transferable unlike MLTA

- A bank is a beneficiary in MRTA whereas it can be anyone in MLTA

- You have pay low premium in MRTA which is more in MLTA

In case of a claim, the home will be given to the beneficiary and the bank will receive the loan through an insurance company. This case is different in MLTA as the beneficiary receives both cash and home.

Which is suitable?

Anyone who is single and has medical insurance should choose MRTA. This is in short good for those with less financial dependents. All the benefits of the loan will go to the bank and not your family members. Well, this is not the motive of taking insurance of someone who wants his loved ones to lead debt life after their death. Hence, MLTA is good for them. They will receive cash value when the policy ends. Having mortgage insurance is worth having so get mortgage level term assurance and protect your loved one’s life after your death.

Now you know which works best for you.