Just like everyone else owns a home is your dream. Wait before you make this dream true. Don’t be in haste to buy a new home as it can turn into a disastrous decision soon if you don’t consider some important factors. Like any other investment, it also matters thus you have to be educated before you buy a house. The basic understanding of owning a home will save you from future effects.

Ask a few questions and decide whether you are ready to buy a home or not.

What are your current financing conditions?

A single most important factor is to know whether you are financially strong or not. Whether you buy a small home or a big one like bungalows it's going to be an expensive decision, make a DSR Calculation before apply your home loan. Your current state depends further on two questions.

Cash for a down payment- in case you are hoping for not involved in any kind of debt and avoid taking loans then be ready with at least 10 to 20 percent of down payment. Moreover, mortgage insurance is an additional investment that is risky for both buyers and bankers. So, get the cash ready.

Mortgage option- those who have no cash for initially down payment can opt for mortgage or loan. However, decide whether you want a fixed-rate mortgage or adjustable-rate mortgage. Check out your repayment conditions and future needs.

Are you stable for the future?

You can always buy now if you have good money for buying a home but the question is will you be stable in the future as well. For example, if you are thinking of a job change then it's better to wait instead of buying now. Once you get financially stable for the future then get a good home now. On the other hand, lenders will first check for your income and job security for giving you a loan. Also, check for future emergencies such as medical problems.

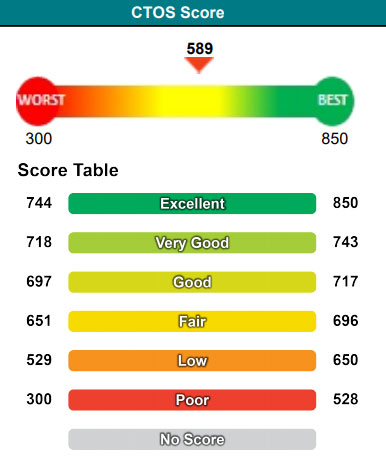

Have you checked ctos credit score?

Your credit state is equally important as a financial state. A buyer with a good score is eligible for a loan. On the other hand, a low credit scorer will get the loan on the high-interest rate. We hope that you don’t want to pay thousands of bucks on repaying your loan, of course not. So, first, have a check on your ctos credit score. If it's not good then improve by making payments of ongoing loans monthly. Don’t take a new loan until your current one is over.

Are you sure of staying in one place?

Many homeowners invest in a home for a few years and then move to other better places. If this is your plan then it’s always good to wait and avoid taking a loan. Initial expenses are more for buying a house. Also, selling them in the future is expensive sometimes. So, consider both the expense in the locality you want to own a home.

Also, check the real estate market value before you buy a home for future selling purposes.

Considering these will help you in knowing whether it's a good time to buy or should you wait for a while. Make your dream home reality once you are ready to invest.